About

Background

Bonding curves are a core building block for token ecosystems. They play a crucial role in managing token price volatility, providing necessary liquidity, and dynamically adjusting token supply. By offering a mathematical framework for defining the relationships between the elements within a token ecosystem, bonding curves enable engineering control over these token ecosystems.

Back in 2018, the Incentivai team proposed the concept of using AI agents for optimizing mechanisms. By observing the behavior of greedy Machine Learning agents, they identified behavior patterns likely to occur once the system is deployed to real users . By comparing these actual behaviors with the expected ones, they continually refined the design of the mechanisms. This concept was explored within Ocean Protocol's bonding curve research, but unfortunately, it was not widely implemented and left no readily available code.

The Bonding Curve Research Group (BCRG) has made significant strides in bonding curve research, development, education, and application since 2023. Their work on the interaction effects between Primary and Secondary Automated Market Makers (PAMMs and SAMMs) is particularly notable. However, as outlined in their article "Modeling & Simulating Bonding Curves", resource constraints have prevented deeper exploration of areas such as malevolent strategies, penetration testing, what-if analysis and so on.

Our team specializes in token engineering, and we are passionate about using agent-based modeling and simulation to optimize complex systems.

Overview

Inheriting the concept from Incentivai, our ProtocolGuard proposal will use AI agents trained through reinforcement learning to explore malicious strategies within various PAMM and SAMM bonding curves combinations. Through further comparative analysis and exploration in Behavior Space, we aim to identify relatively stable, optimal bonding curve parameter combinations. This will allow us to continuously refine protocol design, narrow the gap between expected and actual user behavior, and reduce economic risks within token ecosystems.

In our research, we will focus on:

PAMM bonding curves: Linear, Exponential, Power, and Sigmoid.

SAMM bonding curves: Constant Product Market Maker(e.g Uniswap) and a Hybrid AMM (e.g Curve Finance).

This creates eight different PAMMs/SAMMs combinations.

Our methodology uses agent-based modeling and simulation. We will use AI agents to explore each combination, discover the possible negative or malicious actions, and analyze the likelihood of these behaviors. Also, we will use the simulation to visualize their results, how these malicious actions influence the system, informing countermeasures and improved designs.

We are fortunate to have secured a premium account on Holobit, the first no-coding, visual modeling and simulation infrastructure for protocol design and optimization. This powerful platform will ensure complete transparency throughout our modeling and experimentation process.

Potential Innovations

I. We introduce reinforcement learning into token engineering to form a protocol mechanism optimization method based on AI agents and agent-based modeling and simulation.

II. This method is universal, deployable, and reusable, potentially benefiting the overall economic security of the token ecosystem.

III. Thanks to the powerful tool, our model can be understood, accessible, and verified by the community.

Short-term Goals

I. Utilize AI agents to explore potential malicious strategies within various PAMM and SAMM Bonding Curve combinations, identify potential risks associated with these combinations, and develop corresponding strategies for risk mitigation and mechanism optimization.

II. Provide a scientific and rigorous research method for the development of bonding curves.

III. Based on experimental results, propose several strategies to enhance the economic security of the token ecosystem from a bonding curve perspective.

Long-term Goals

By integrating AI's agent-based modeling and simulation methods with advances in token engineering, we can open up the possibility for anyone to become a token engineer. This foundational approach fosters the development of token ecosystems that are both resilient and sustainable through community-driven, decentralized efforts. Such a framework not only promotes the field of token engineering but also accelerates the evolution of its theoretical and practical applications.

Team

@Elaine:Researcher specializing in token engineering, with expertise in agent-based modeling (ABM) simulations for complex economic systems.

@Jereyme: Token engineer holding five TEA NFTs, with expertise in the crypto industry and applications of bonding curves.

Current State

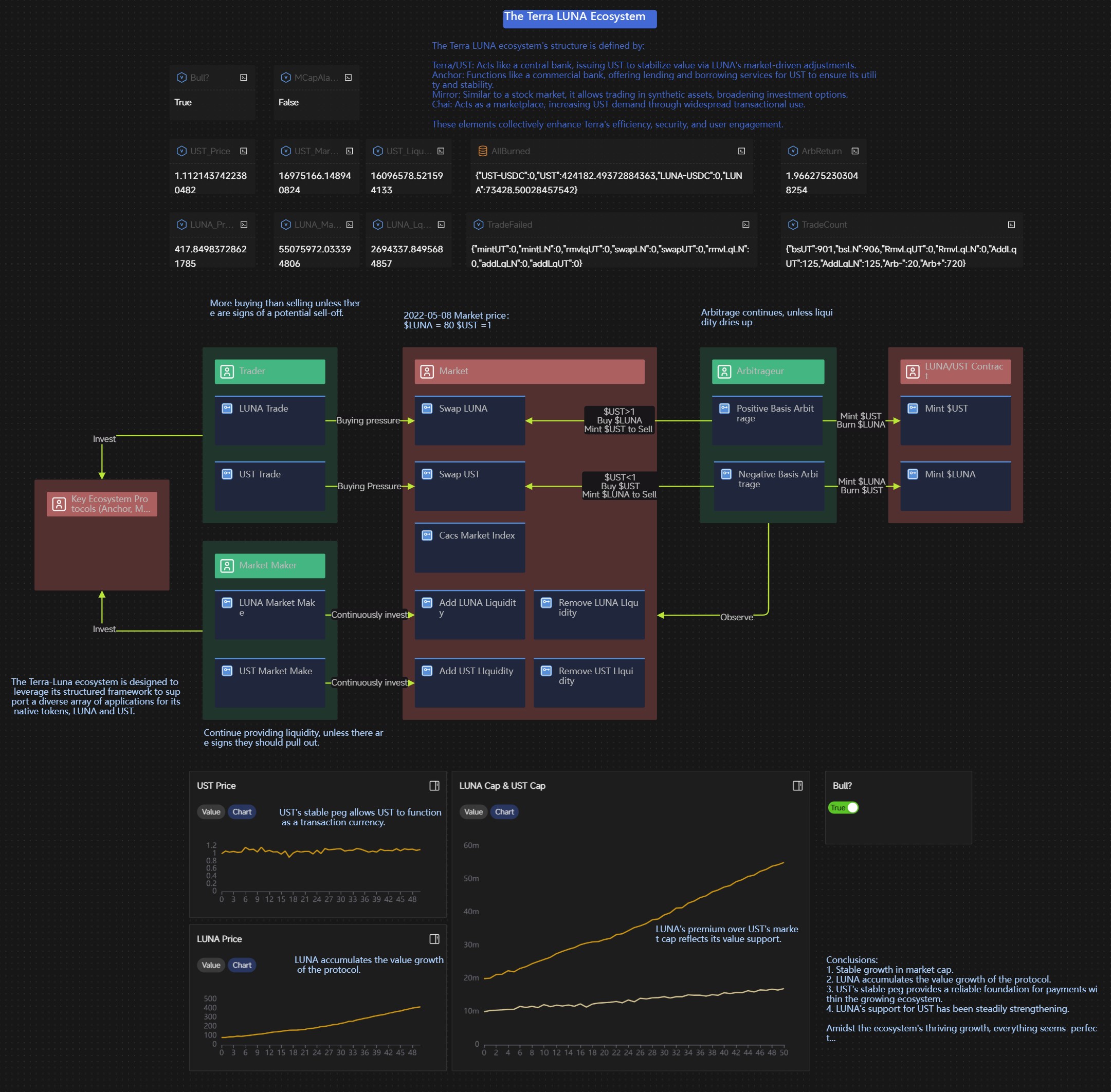

We have replicated the core mechanism of Terran/LUNA's collapse through modeling, with links and screenshots of the Terra/LUNA case provided.

Scenario 1, Bull market:

https://app.holobit.world/embed/9ec46684798598c1c92b13a94231f9d429c0c4c8d9f2579069fb78b41e86c37b

Scenario 2, Bear market:

https://app.holobit.world/embed/9e9dbc531214e37ba84e254470326ff3b50314a91bd0cea6e50957924be628c7

Scenario 3, Bull market & Attack:

https://app.holobit.world/embed/7b9020e2fd1da643a2d4f424d8c72f579da30975e62430810e8261f5d1f90aa0

Initial research on Bonding curves has commenced.

Expected Deliverables

With the aid of the HoloBit tool for agent-based modeling, we anticipate the following deliverables:

- An off-chain simulation model that incorporates AI agents, featuring experimental schemes for eight distinct PAMM and SAMM combinations. This model will be fully transparent, easily understandable, usable, and verifiable by the community.

- A research report on potential malicious strategies for various PAMM and SAMM Bonding Curve combinations, featuring AI-agent-driven explorations, modeling details, experimental results, vulnerability analysis, and optimization strategies.

Mission and Value Alignment

Accessibility: Our model, built on the Holobit modeling platform, is designed as an accessible public resource for exploration and testing. This platform empowers us to deliver visual clarity, promote open sharing, and ensure the model's readability, usability, and verifiability. The Terra LUNA case study above serves as a great example.

Education: The detailed models enable deep understanding of bonding curves and their critical roles within the token ecosystem. Using agent-based modeling and simulation, we illustrate methods to analyze and manage dynamic relationships and potential risks in complex systems. These skills are essential for researching token engineering and can be widely applied, fostering broader adoption and innovation in the field.

Transparency: True transparency is achieved when models are comprehensible to the community. The model does not involve complex coding and uses the tool to visualize both the mechanisms and the experimental processes involved. This approach not only clarifies the workings of the model but also highlights associated risks and offers specific mitigation strategies.

Community-driven: The community can fork this model to conduct a variety of experiments, not limited to bonding curves but also including studies on protocol governance, growth and so on. More importantly, this methodology and tool can be reused in other protocols. Everyone can publicly share their research findings, disclose vulnerabilities and areas for improvement in the token ecosystems, and truly achieve community-driven self-regulation.

Alignment with Token Engineering Principles: The proficiency in these methods and tools equips individuals to perform economic security audits of protocols, supporting the practical implementation of decentralized token engineering. This skillset enables the utilization of collective intelligence to develop token ecosystems that are both more resilient and sustainable.

ProtocolGuard:AI-Driven Exploring Potential Malicious Strategies in PAMMs & SAMMs History

-

accepted into Token Engineering QF Grants Round: Spring 2024 6 months ago.