Washika DAO: Empowering Marginalized Communities with Governance & Alternative Financing.

Project Description: Washika DAO is a framework and protocol aimed at transforming governance and financial inclusion for marginalized communities such as Village Community Banks (VICOBAs), Savings and Credit Cooperative Societies (SACCOS), and Chamas across communities in Africa and the global south overall. Built on the Celo blockchain and leveraging the use of stablecoins, Washika DAO provides a robust platform for savings, lending, and governance, designed to empower communities and promote sustainable economic growth.

Issues We’re Tackling In emerging markets, access to credit remains a critical barrier to economic growth and financial inclusion. Traditional banking systems often fail to serve the needs of small businesses and individuals, especially those in low-income earning communities. Despite the progress in making banking services accessible such as banking the unbanked with a basic feature phone and an ID barriers to credit access continue to impede financial empowerment. High-interest rates, stringent lending requirements, and limited financial literacy are significant challenges.

Our focus is on scalable solutions that integrate innovation with existing community practices, such as the Washika DAO protocol, to create sustainable economic growth and resilience, while critically assessing the trade-offs and impacts on marginalized communities. By examining the potential of novel credit systems to empower local economies, enhance financial autonomy, and reduce dependency on conventional traditional structures.

Traditional centralized means of financial inclusion such as Mpesa exist but at what cost are marginalized communities truly financially included?

- Financial Exclusion: Millions of people in marginalized communities lack access to basic financial services. Washika DAO provides an inclusive platform that empowers these communities through alternative means to financing in DeFi.

- Lack of Transparency: Traditional financial systems often suffer from opacity and corruption. Our blockchain-based solution ensures all transactions and decisions are transparent and immutable as well as all governance decisions stored onchain for transparency and proper record keeping.

- High Transaction Costs: By leveraging decentralized finance (DeFi) principles and stablecoins utilities, we significantly reduce the cost of transactions, making financial services more affordable for marginalized communities facing high transaction costs.

- Inefficient Lending Processes: Traditional lending processes can be slow and bureaucratic. Washika DAO automates and streamlines the process, providing quick and fair access to credit.

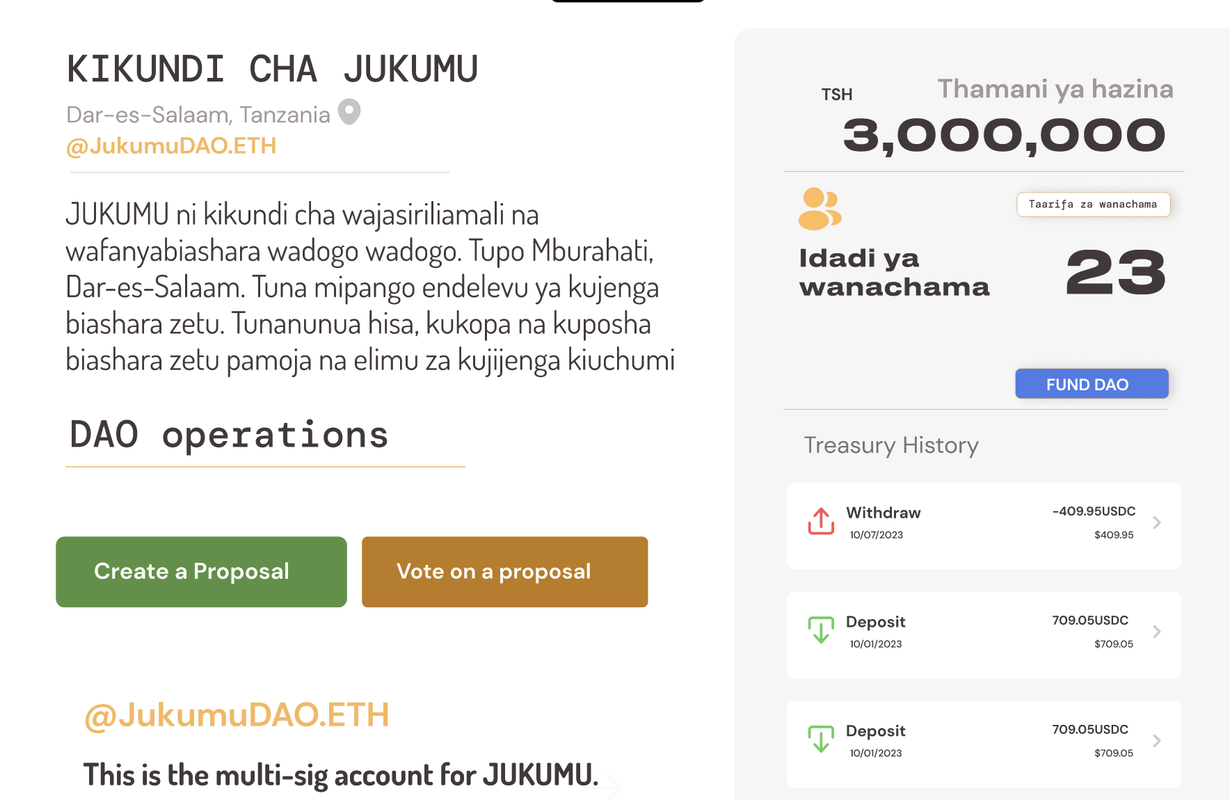

Governance

- At the heart of Washika DAO is a decentralized governance model that ensures all members have a voice in the decision-making process. Any existing Chama can create a DAO in 3 simple steps, adding relevant fields such as members, multisig holders etc. without having to worry about web3. Anyone in the DAO is also able to put up a proposal reviewed by all at anytime. Key features include:

- Democratic Voting: Members can propose and vote on changes to the protocol, interest rates, loan terms, and other critical decisions.

- Transparent Operations: All governance activities are recorded on the blockchain, ensuring transparency and accountability.

- Community-driven Proposals: Any member can submit proposals, fostering a collaborative environment where the best ideas can flourish.

Savings: Communities already operate a savings pool offchain through a model known as “Mchezo'' in Swahili, where the funds pooled shift hands every month. Washika DAO’s savings mechanism is designed to encourage financial discipline and provide a safe, transparent way to save money:

- Secure & Transparent Savings Accounts: Members can open savings accounts that are securely managed by smart contracts. The balances will be scraped from their existing holding accounts such as bank / mobile money wallet (M-Pesa)

- Interest Earnings: Savings pooled in the DAO earn interest, which is distributed back to the members proportionally. This adds value to the idle funds sat in their pool/ bank account.

- Automated Management: In the near future, Smart contracts automate the process of interest calculation and distribution, ensuring efficiency and accuracy.

Lending (In the near future):

- Washika DAO revolutionizes the traditional lending process with a decentralized, community-focused approach:

- Peer-to-Peer & Group Lending: Members can apply for loans that are funded directly by the community’s pooled savings. Communities can also collectively apply for a loan at better terms through a collateralized asset, such as liquid bond in this case.

- Fair Loan Terms: Loans are granted based on predefined criteria, ensuring fairness and reducing the risk of default.

- Automated Repayments: Repayment schedules are managed by smart contracts, making the process seamless and reliable.

What We’re Building: Comprehensive Governance & Financial Platform: A user-friendly interface for participating in governance, transparency in managing of funds and savings as well as applying for cost-efficient loans through alternative means of financing.

Automated savings pool: A protocol to ensure governance security and transparency for these communities, alternative means of financing utility in pooled & automated savings, stablecoin settlements & store of value and efficiency. We are also making the User experience as friendly as possible by mapping their wallets in the backend to their mobile phone numbers and linking their National IDs. This will also enable tracking of history and records.

Educational Resources: Providing training and support to help members understand and effectively use the platform. This includes a DAO toolkit, all accessible in English and Swahili local language.

Community Tools: Features to facilitate collaboration, knowledge sharing, and collective decision-making.

WashikaDAO History

-

accepted into GG22 OSS - dApps and Apps 4 months ago.

-

applied to the OpenCivics Collaborative Research Round 7 months ago which was rejected