Summary

We plan to create “Arbitrum RWA Academy” that targets a significant challenge in the real-world asset (RWA) space—namely, the complexity and inaccessibility that often deters both retail investors and new developers. RWAs assets provide essential diversification and stability in the investment portfolio but entering this market through blockchain technology poses significant hurdles. These include understanding legal jurisdictions, the specific structures of RWA providers, and the underlying asset implications. The complexity of these factors results in a steep learning curve that can be daunting even for seasoned investors, thereby limiting the participation primarily to institutional entities.

Our RWA Academy website seeks to democratize access to RWAs by enhancing product awareness, simplicity, and transparency. There is a notable gap in the understanding and accessibility of simple, secure transactions involving RWAs on-chain, compared to traditional methods like banks or financial institutions. Addressing this gap is crucial to fostering the growth of the RWA ecosystem. By providing clearer, more accessible educational resources and straightforward product offerings, we aim to make it easier for everyday users and new developers to engage with RWAs. This will not only increase retail interest and participation but also encourage innovation and development within this sector by those who may have previously been deterred by its complexities.

Our efforts are directed towards creating educational content and tools that simplify these complex concepts and procedures. By doing so, we aim to build a knowledgeable community capable of navigating RWA investments confidently, thereby contributing to a more inclusive and robust financial ecosystem that benefits a diverse range of investors.

Slides

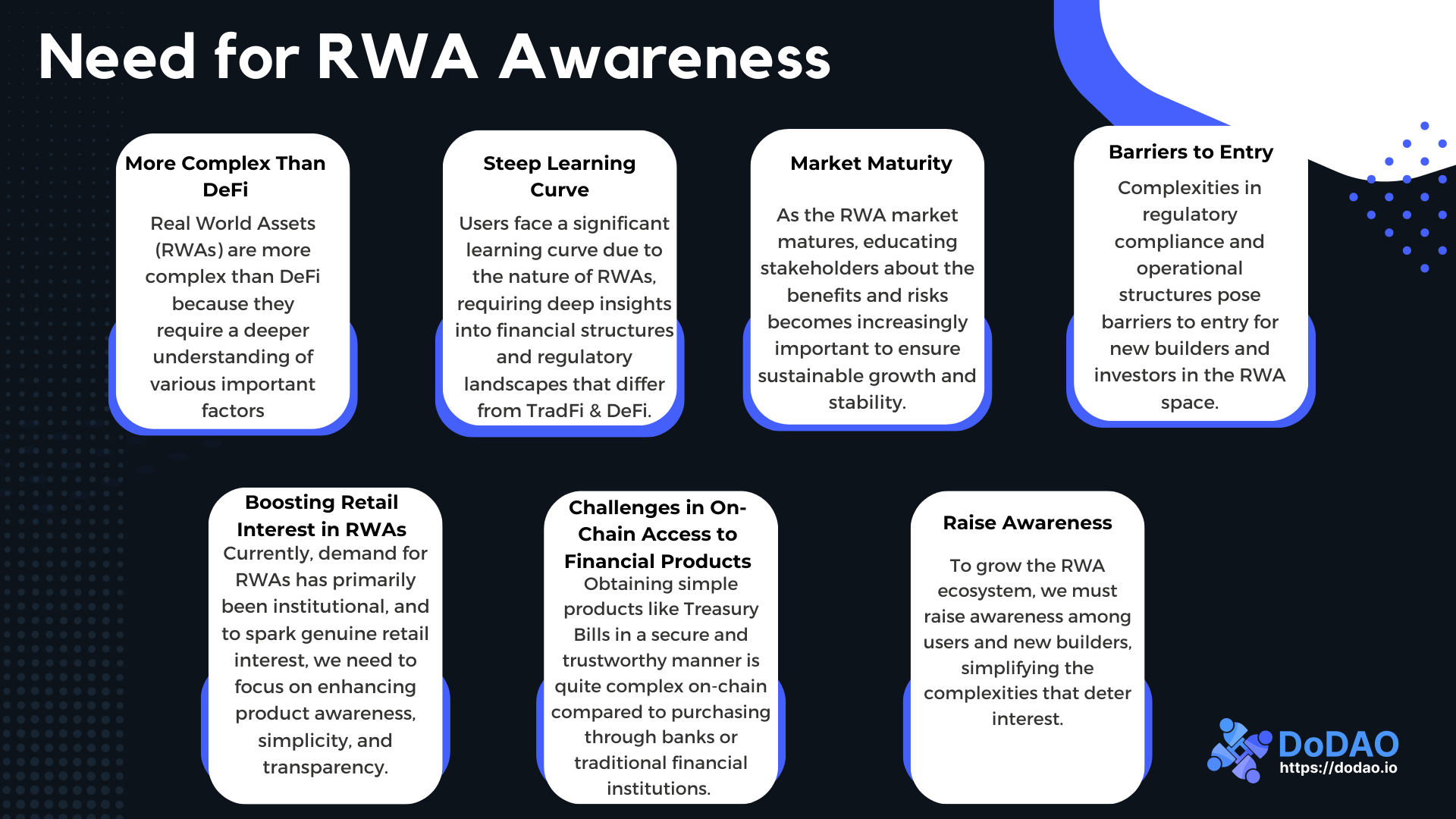

Need for RWA Awareness

Currently, understanding Real-World Assets (RWAs) is even more complex than DeFi. Apart from grasping the transaction flow and yields, users must also be aware of the jurisdiction of the fund, the structure of the RWA provider, the type of asset provided, and the implications of each element.

We have compiled a list of all RWA projects that applied for the STEP program, available here:

https://docs.google.com/spreadsheets/d/1JBgQbHZJLUDjnqWU0_j7QJxin6jlff2_cXAdMWKV0OM/edit?gid=0#gid=0.

Understanding the structure and risks associated with these projects was a daunting task for the program committee, which had years of experience in both traditional finance and DeFi, as well as RWAs. For users, this represents a very steep learning curve. Currently, demand for RWAs has primarily been institutional, and to spark genuine retail interest, we need to focus on enhancing product awareness, simplicity, and transparency.

Obtaining simple products like Treasury Bills in a secure and trustworthy manner is quite complex on-chain compared to purchasing through banks or traditional financial institutions. To foster the growth of the RWA ecosystem, we must work on raising awareness not just among users but also among new builders who are interested in this space but are deterred by its complexities.

DoDAO’s Alignment and Perspectives on RWAs

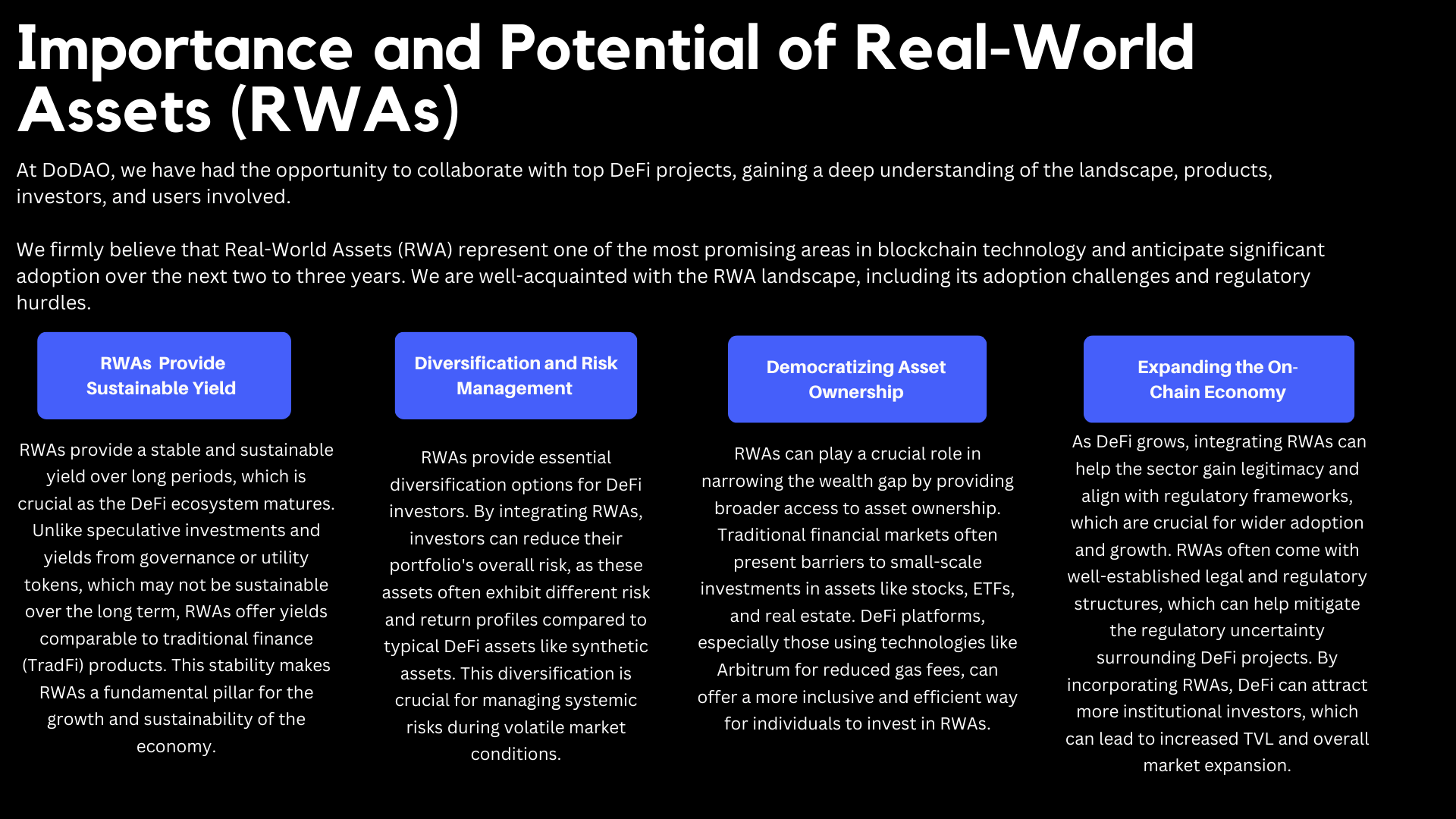

At DoDAO, we have had the opportunity to collaborate with top DeFi projects, gaining a deep understanding of the landscape, products, investors, and users involved. As builders ourselves, we have developed a couple of products and tools within the blockchain space.

We firmly believe that Real-World Assets (RWA) represent one of the most promising areas in blockchain technology and anticipate significant adoption over the next two to three years. We are well-acquainted with the RWA landscape, including its adoption challenges and regulatory hurdles. As bootstrapped builders, these challenges are particularly steep for us, prompting us to engage in extensive research concerning regulatory compliance and asset procurement.

Below is our viewpoint on why RWA is the most promising area in Web3

Importance of RWAs for On-chain finance

The success of financial institutions can be measured by key indicators such as Assets Under Management (AUM) or Total Value Locked (TVL) within the institution, as well as the yield or value it provides to its users. Both DeFi and NFT projects have significantly contributed to the growth of TVL in the on-chain economy by providing real utility and value.

The yield offered to investors plays a crucial role in the ecosystem's growth. Excluding speculative investments and yields from governance or utility tokens, the net sustainable yield from pure on-chain products is generally lower compared to traditional finance (TradFi). Most DeFi yields rely on the sale of utility or governance tokens, and as the ecosystem matures, it will become challenging to sustain these yields over long terms like 10 years or more.

In contrast, TradFi products offer more stable yields over longer periods, such as 5 or 10 years. Consider whether you would prefer to invest in Uniswap as a liquidity provider, or in AAVE/Compound for a 10-year term, compared to investing in a market index or an ETF for a 5 to 10-year term.

When considering long-term investments and sustainability (10 years or more), the importance and need for Real-World Assets (RWAs) becomes clear. They are, in fact, a fundamental pillar of the on-chain economy. Bringing RWAs onto the blockchain is beneficial not just for the on-chain economy but also for the RWAs themselves, as DeFi technologies and composability greatly enhance the utility of RWA projects.

The best financial products can be created by combining both RWAs and DeFi projects. RWAs act as the base layer, providing a consistent yield, while DeFi projects layered on these assets offer global accessibility, composability, and utility.

Importance of RWAs for Individuals

Every year we see that the rich are becoming richer and poor and becoming poorer, and one of the primary reasons is because the unprivileged class doesn’t hold many assets. The percentage of assets to cash of a rich individual is very different from that of the middle class. Rich will have a lot more % of the total capital in assets and little in cash, whereas it's the opposite for the middle class.

Alternatively, consider two individuals at the age of 25 who have the same net worth and same yearly income, one keeps all of their net worth in cash or USD, and other individuals keep all their network in real assets like ETFs, Index funds, real estate etc in a diversified way. When we compare their network at the retirement age i.e. at 65 or 70, they will have completely different outcomes. The one who had invested in assets would be many times, literally “many times” richer than the other.

Currently purchasing Assets(stocks/ETFs/Index Funds) for small amounts is very inefficient in Traditional financial markets. Alternatively, DeFi protocols coupled with low gas fees or Arbitrum, provide a much seamless and inclusive experience for users.

This is where we see many projects in the coming years will be using Arbiturm Orbit, DeFi protocols, and will be giving the best of both Web2 experience, and Web3 utility to its users.

Why DoDAO?

DoDAO is one of the most detailed educational content creators. We have worked with the top DeFi and blockchain projects towards building their Academy Websites.

Our Academy sites

- https://uniswap.university/

- https://arbitrum.education/

- https://compound.education/

- https://optimism.university/

- Uniswap's V4 Technical Documentation (Done)

- Alchemix Academy (In Progress)

- +more

DoDAO's Products

- Academy Site Builder

- Tidbits Hub(Tidbits & Clickable-Demos/Simulations)

- RWA - Bring middle eastern assets on-chain and provide access to western customers(In Research Phase)

Governance Tooling Initiatives

- Onchain Governance Proposal Analyzer for Compound (Done)

- Command Line Interface code generation POC for Compound's Governance (Done)

- Asset Analysis Dashboards(In Progress)

- Optimistic Governance (In pipeline)

We take a team based approach and for this initiative we will be working with a team of 2 full-time researchers for a period of 7-8 weeks.

Once approved, we can share the exact team members who will be working on this initiative.

Here's your text with corrected grammar and improved structure for clarity:

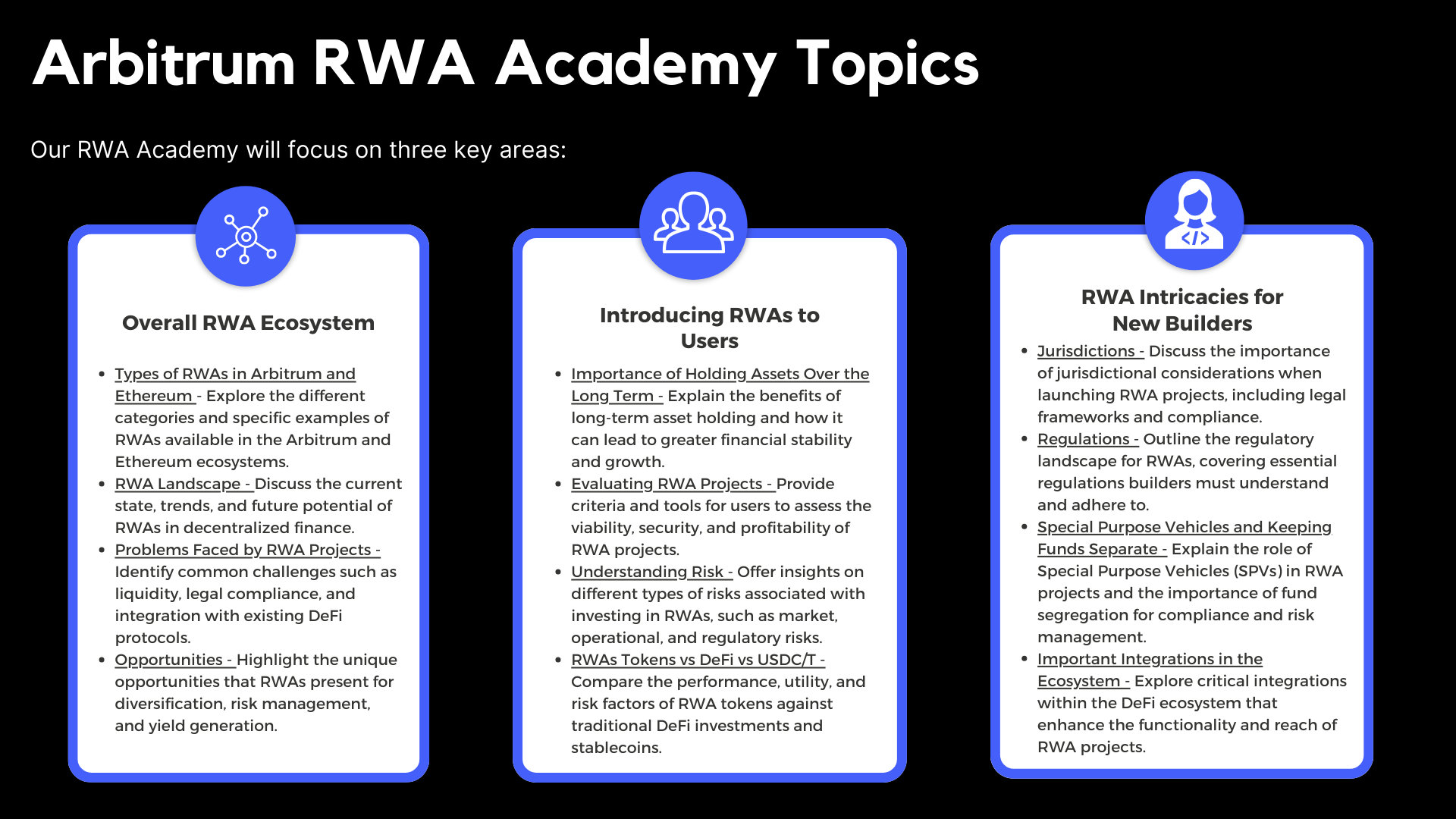

Arbitrum RWA Academy Topics

Our RWA Academy will focus on three key areas:

- Educating about the RWA ecosystem.

- Educating users about RWA projects, their benefits, and risks.

- Educating builders about regulations, structuring, and important integrations within the ecosystem.

Currently, no resources are available that delve into these areas in depth. For each topic, we plan to create:

- 3-5 detailed guides, explaining some of the important topics within these areas.

- 10-15 tidbits, covering the most crucial information in these areas, designed to allow readers to learn more about each topic in under 5 minutes.

In total, we will be creating 9-12 guides and 30-40 tidbits.

Below are some the topics we plan to cover in the three areas

Overall RWA Ecosystem

- Types of RWAs in Arbitrum and Ethereum - Explore the different categories and specific examples of RWAs available in the Arbitrum and Ethereum ecosystems.

- RWA Landscape - Discuss the current state, trends, and future potential of RWAs in decentralized finance.

- Problems Faced by RWA Projects - Identify common challenges such as liquidity, legal compliance, and integration with existing DeFi protocols.

- Opportunities - Highlight the unique opportunities that RWAs present for diversification, risk management, and yield generation.

Introducing RWAs to Users

- Importance of Holding Assets Over the Long Term(RWAs vs Stablecoins over long term) - Explain the benefits of long-term asset holding and how it can lead to greater financial stability and growth.

- Evaluating RWA Projects - Provide criteria and tools for users to assess the viability, security, and profitability of RWA projects.

- Understanding Risk - Offer insights on different types of risks associated with investing in RWAs, such as market, operational, and regulatory risks.

- RWAs Tokens vs DeFi vs USDC/T - Compare the performance, utility, and risk factors of RWA tokens against traditional DeFi investments and stablecoins.

RWA Intricacies for New Builders

- Jurisdictions - Discuss the importance of jurisdictional considerations when launching RWA projects, including legal frameworks and compliance.

- Regulations - Outline the regulatory landscape for RWAs, covering essential regulations builders must understand and adhere to.

- Special Purpose Vehicles and Keeping Funds Separate - Explain the role of Special Purpose Vehicles (SPVs) in RWA projects and the importance of fund segregation for compliance and risk management.

- Important Integrations in the Ecosystem - Explore critical integrations within the DeFi ecosystem that enhance the functionality and reach of RWA projects.

Arbitrum Focus

DoDAO has created the most comprehensive educational content on Arbitrum, available at https://arbitrum.education, and has compiled a list of all the RWA projects during the STEP phase, accessible here: https://docs.google.com/spreadsheets/d/1JBgQbHZJLUDjnqWU0_j7QJxin6jlff2_cXAdMWKV0OM/edit?gid=0#gid=0

Therefore, we possess the most in-depth knowledge of Arbitrum and all its products, as well as the RWA projects active in the Arbitrum ecosystem.

The goal of our RWA Academy is to make it very easy for any user to find the RWA project of their choice in Arbitrum and to understand its structuring, assets, and yields. Simultaneously, we aim to simplify for any builder the basics of regulations and jurisdictions, thereby reducing their initial effort and inertia.

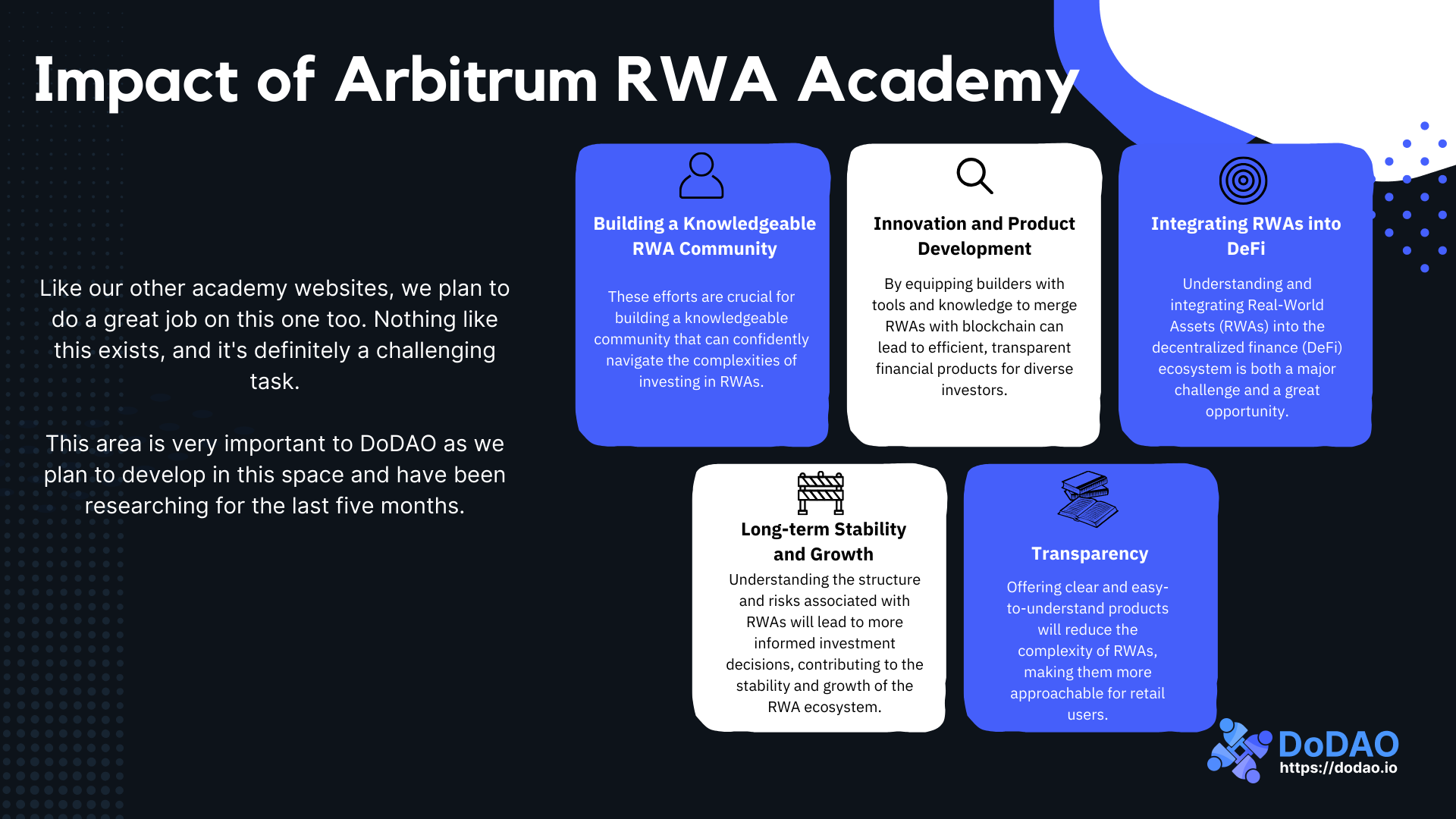

Impact of Arbitrum RWA Academy

Our “RWA Academy Website” will be focusing on simplification, education, and accessibility of RWA, which sets us apart from existing initiatives. Many current RWA projects on Arbitrum are complex and not very accessible to average users due to the deep knowledge required about jurisdictions, asset structures, and the role of RWA providers. Our academy website aims to dismantle these barriers by creating a comprehensive educational portal that offers easy-to-understand guides and tutorials on RWAs. This portal will serve both new and experienced users, enhancing their understanding and making it easier for them to participate in the RWA ecosystem.

Additionally, the RWA Academy website weil be designed to attract a broader audience, including retail investors who have so far been mostly sidelined in the RWA space, which has been dominated by institutional participants. By providing clear, transparent, and simplified content about how to invest in and benefit from RWAs, we aim to democratize access to these assets. This effort will not only increase the user base but also foster a more inclusive environment.

Moreover, our initiative is not just about attracting users but also empowering builders and developers in the RWA space. We intend to offer detailed insights into regulatory compliance and asset procurement, which are critical hurdles for new entrants. By equipping builders with the necessary tools and knowledge through targeted workshops and resources, our project will facilitate innovation and the development of new RWA solutions on Arbitrum. This will enhance the overall value of the Arbitrum RWA ecosystem, bringing in fresh perspectives and innovative projects that leverage the unique features of decentralized finance and blockchain technology.

Effort and Cost Estimates

Team Effort: 2 Full-time Researchers for 7-8 weeks

Effort in Hours: 2 researchers * 40 hours/week * 8 weeks = 640 hours

Cost: $75/hour

Total Cost: 640 hours * $75/hour = $48,000

This will be the genuine cost of the research.

However, since we have already been working on some of these research topics and it aligns with our ongoing efforts and research, we plan to request a grant of 30,000 ARB or $25,000 for this project. We believe that this research will benefit the community and will help in establishing Arbitrum as a hub for RWAs.

Arbitrum RWA Academy History

-

applied to the Arbitrum RWA Innovation Grant Program 4 months ago of which the application is still in a pending state