Summary

It's been over seven years since the Ethereum community began discussing tokenizing real-world assets, yet there are only a few successful projects. In contrast, there are approximately 20-50 projects each for various DeFi uses like lending, decentralized exchanges, and Perpetuals.

Tokenizing real-world assets is complex, requiring significant investments of both funds and time to start. Builders must navigate both technological and regulatory challenges and also attract retail users.

Our research aims to support both builders and users. We plan to produce one of the first detailed reports in the real-world asset (RWA) community. This will serve as a reference for builders and interested users. We hope more researchers will build on our work, creating useful blueprints for future projects.

For builders, we aim to provide all the basic information needed to navigate the legal space. We are not lawyers, but we have a sufficient understanding to publish general guidelines and best practices, which can save new builders months of effort and tens of thousands of dollars in legal costs. Real value is added to the ecosystem only when the product is available for retail users. Currently, almost all RWA products are for institutional investors, and we also want to find and present guidelines and best practices for new projects, helping them work towards offering the product to retail users.

For users, we want to simplify the process of evaluating RWAs. Currently, each project uses its own terminology, and most don't even disclose important information like company and fund structure. We plan to create rubrics on which RWA projects can be rated. This will help users be aware of the projects based on the evaluations, assist builders in developing more genuine projects, and enable users to choose the best projects.

Impact of our Research

We expect our research to save tens of thousands of dollars in initial legal fees typically paid to lawyers for basic knowledge, and it will also reduce the effort required by each builder by at least three months.

Furthermore, our research will enhance transparency within the ecosystem and help users differentiate between reputable projects and those that are more convoluted.

Note: We would like to reiterate that we are not lawyers, nor are we a substitute for legal advice. However, we strongly believe that our work will significantly reduce the initial legal fees and effort builders expend to understand the basic legal jurisdictions and regulations.

Slides

Proposal Introduction

The STEP initiative has been great for boosting Assets Under Management (AUM) for several promising RWA projects on Arbitrum, aligning them with the platform and generating yield.

However, there's still a lot to do to make RWAs truly accessible for retail users. Stablecoins like USDC and USDT are a big part of retail portfolios but don't earn interest.

If Arbitrum's RWA efforts can replicate the user experience of USDC and USDT, offering, for instance, a 5% yield with equivalent safety, security, and accessibility, these RWAs could become preferred choices over stablecoins.

The ultimate goal of our research deliverables is to make RWA projects as accessible and beneficial as stablecoins. To achieve this, we're focusing on:

-

Legal Structures for Builders and Awareness for Users

- Legal Structures for Builders - Currently, if a builder understands the technology and wants to develop a DeFi app, they can start coding immediately. However, with RWAs, they must spend at least two months learning basic regulatory/legal requirements. The associated effort cost is at least $50,000, deterring many builders from pursuing RWAs.

- Legal Awareness for users - While RWAs may struggle to compete with DeFi yields, offering the same simplicity and security as stablecoins could make them the natural choice over stablecoins. We need to simplify the understanding of RWAs for users, reducing the current effort cost of $500-$1000 per user. If we can reduce the effort required to understand RWAs to less than 20-30 minutes, adoption could increase significantly. Consistent efforts in these areas could potentially attract billions of dollars into RWAs over time.

- Create Rubrics or Criteria for Evaluating RWAs - To help users make informed decisions, we will develop clear rubrics or criteria for evaluating RWAs. By establishing standardized evaluation parameters, we aim to make it easier for users to compare different RWAs and choose investments that meet their needs and expectations.

- Simplified Purchase Process & Focus on Retail - Currently, the purchase process for RWAs varies widely among projects, which can be difficult for retail users. Our research will explore ways to simplify the onboarding process, streamline KYC procedures, and standardize the purchase process.

Viability and Relevance of the Research

The viability of this research is strong, as DoDAO has been actively engaged in related activities over the past three months, especially in integrating Middle Eastern assets on-chain and providing access to Western customers. We have already achieved significant progress in these areas and are well-prepared to cover them comprehensively.

While the research is entirely viable, it is equally important that it remains highly relevant. Throughout the compilation of this list: https://docs.google.com/spreadsheets/d/1JBgQbHZJLUDjnqWU0_j7QJxin6jlff2_cXAdMWKV0OM/edit?gid=0#gid=0, we connected with several members from various real-world asset (RWA) projects. We will ensure that our research deliverables are reviewed by these stakeholders to maintain relevance and applicability.

Arbitrum Focus and Making Arbiturm home to RWAs

This research builds upon the successful groundwork laid by the STEP initiative and serves as a crucial precursor to future initiatives within Arbitrum. While STEP has effectively increased Assets Under Management (AUM) and yield for RWAs, it has not fully addressed the need to boost on-chain transactions, improve overall usability, and enhance retail access to these assets.

The primary objective of this research is to significantly enhance the accessibility and usability of Real World Assets (RWAs) on the Arbitrum network. By focusing on simplifying legal structures, reducing entry barriers for builders, and improving user understanding and engagement, we aim to establish a solid foundation. This foundation will not only strengthen the current ecosystem but also set the stage for more impactful programs and initiatives in the future.

Investing in this research now is crucial as it will not only optimize existing efforts but also ensure that future programs are built upon a robust framework designed to maximize usability, accessibility, and adoption of RWAs on Arbitrum.

Research Deliverables and KPIs

The following KPIs will guide the success of our research and its practical application:

- Our research aims for a quality rating of 8 out of 10, ensuring our findings and recommendations are robust, thorough, and actionable.This benchmark ensures that our work provides valuable insights and practical guidance for integrating Real World Assets (RWAs) into the Arbitrum ecosystem effectively.

- We will also produce three detailed write-ups, each approximately 10-15 pages in length, covering critical areas relevant to the integration and adoption of Real World Assets (RWAs) in the Arbitrum ecosystem.

- Post-research, we will conduct four interactive sessions to ensure our findings have a real-world impact.

Team:

DoDAO Team

DoDAO has been working on many tooling and educational initiatives in the blockchain space. We have been working with some of the top projects in the space and have been contributing to the ecosystem in various ways. We have been working on

DoDAO's Products

- Academy Site Builder

- Tidbits Hub(Tidbits & Clickable-Demos/Simulations)

- RWA - Bring middle eastern assets on-chain and provide access to western customers(In Research Phase)

We have also compiled a list of all STEP applications, so we have a good understanding of the projects within the STEP initiative. Additionally, we are well aware of the challenges faced in the RWA space. https://docs.google.com/spreadsheets/d/1JBgQbHZJLUDjnqWU0_j7QJxin6jlff2_cXAdMWKV0OM/edit?gid=0#gid=0

Educational Initiatives

- https://uniswap.university/

- https://arbitrum.education/

- https://compound.education/

- https://optimism.university/

- Alchemix Academy (In Progress)

Governance Tooling Initiatives

- Onchain Governance Proposal Analyzer for Compound (Done)

- Command Line Interface code generation POC for Compound's Governance (Done)

- Asset Analysis Dashboards(In Progress)

- Uniswap's V4 Technical Documentation (Done)

We take a team based approach and for this initiative we will be working with a team of 2 full-time researchers for a period of 7-8 weeks.

Once approved, we can share the exact team members who will be working on this initiative.

Research Topic Details

Legal Structures for Builders and Awareness for Users

a) Implications for RWA Providers

Tokenization of real-world assets has been discussed for a few years, but it still hasn't become widely adopted. Despite their real value, few developers are working on these projects, and there are no standard blueprints. The main reason is the need for clearer regulatory information. The goal of this research is to provide a starting point for developers, helping them begin at an advanced stage rather than starting from scratch. We aim to address some common questions that every real-world asset project faces.

- Fund Registration Country Comparison: Each fund registration country provides specific flexibilities and restrictions. We aim to compare these across the British Virgin Islands, Bermuda, the United States, the Cayman Islands, and Singapore.

- US regulations for RWAs: Depending on the target audience of the Funds, RWA providers must comply with specific US regulations. We will compare these regulations and highlight several projects that have adhered to them.

- EU Regulations for RWAs: We haven't seen many details on this in the STEP applications, but we want to find and compare the most common regulations in the EU and determine when a fund should apply for those regulations.

- KYC/AML Requirements and Solutions: Every country that registers funds has KYC/AML requirements, which also restrict the adoption of real-world assets (RWAs) in the Ethereum ecosystem. We aim to study different requirements and on-chain solutions that facilitate customer onboarding to RWA projects.

- Requirements for Sale/Resale of RWAs: To enhance the utility of RWA projects, it's crucial that tokens are freely transferable. We'll discuss the restrictions imposed by various jurisdictions on asset transfers and the setups that permit unrestricted selling of RWA assets.

b) Implications for RWA Users/Customers

Most real-world asset (RWA) projects tend to offer lower yields than new DeFi projects. Retail users will only prefer RWA projects if they are safer, simpler, and more user-friendly.

Currently, almost every RWA project differs significantly from others, which complicates things and creates a steep learning curve for retail users. This research aims to simplify understanding and learning about legalities of RWA projects for end users.

-

Is it safe? - DeFi protocols might offer higher yields compared to RWA projects due to the associated risks. Consequently, RWAs inherently need to provide greater safety than other platforms to compensate. We will cover the essential aspects that users should understand about the safety of RWAs, both from offering and regulatory perspectives.

-

Is it usable? - Due to the whitelisting aspects, it is crucial that users understand the limitations regarding the usability of assets. Like other DeFi assets or tokens, many of these real-world assets (RWA) cannot be sold or resold. These restrictions are primarily enforced by protocols; however, users should also be aware of the regulatory constraints before investing in any asset.

-

Legal Jargons? - One of the biggest benefits of blockchain is having open, verifiable information. RWAs on blockchain should be simpler than traditional banking assets. However, RWA projects often use complex terms like "Bankruptcy Remote," which can be hard for ordinary users to understand. We will create a list of the most commonly used jargon in the RWA world to help ordinary users understand the offerings more easily.

Create Rubrics or Criteria for Evaluating RWAs

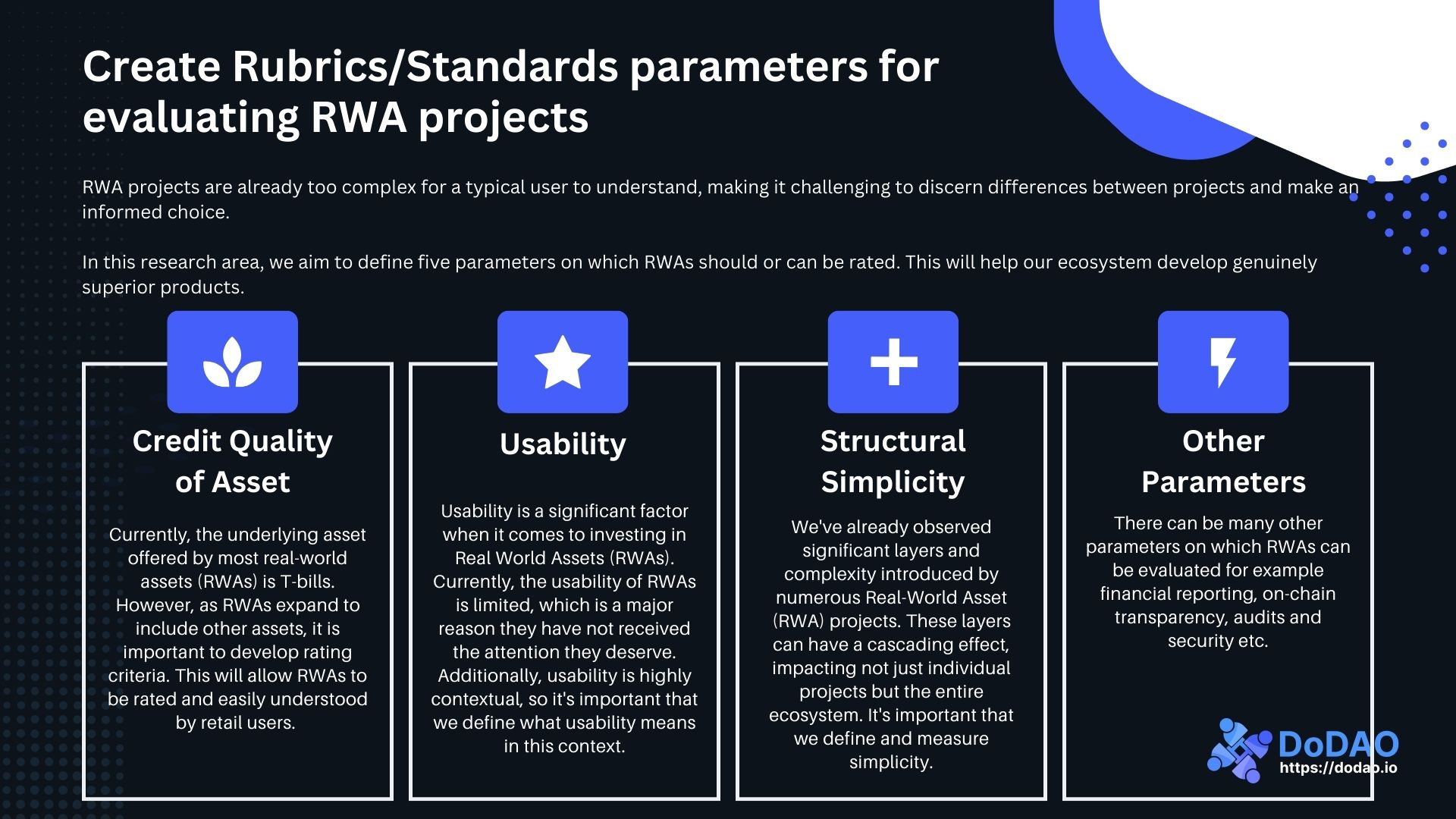

RWA projects are already too complex for a typical user to understand, making it challenging to discern differences between projects and make an informed choice.

In this research area, we aim to define five parameters on which RWAs should or can be rated. This will help our ecosystem develop genuinely superior products.

- Credit Quality of Asset: Currently, the underlying asset offered by most real-world assets (RWAs) is T-bills. However, as RWAs expand to include other assets, it is important to develop rating criteria. This will allow RWAs to be rated and easily understood by retail users.

- Usability: This is a significant factor when it comes to investing in Real World Assets (RWAs). Currently, the usability of RWAs is limited, which is a major reason they have not received the attention they deserve. Additionally, usability is highly contextual, so it's important that we define what usability means in this context.

- Structural Simplicity: We've already observed significant layers and complexity introduced by numerous Real-World Asset (RWA) projects. These layers can have a cascading effect, impacting not just individual projects but the entire ecosystem. It's important that we define and measure simplicity.

- Other Parameters: There can be many other parameters on which RWAs can be evaluated for example financial reporting, on-chain transparency, audits and security etc.

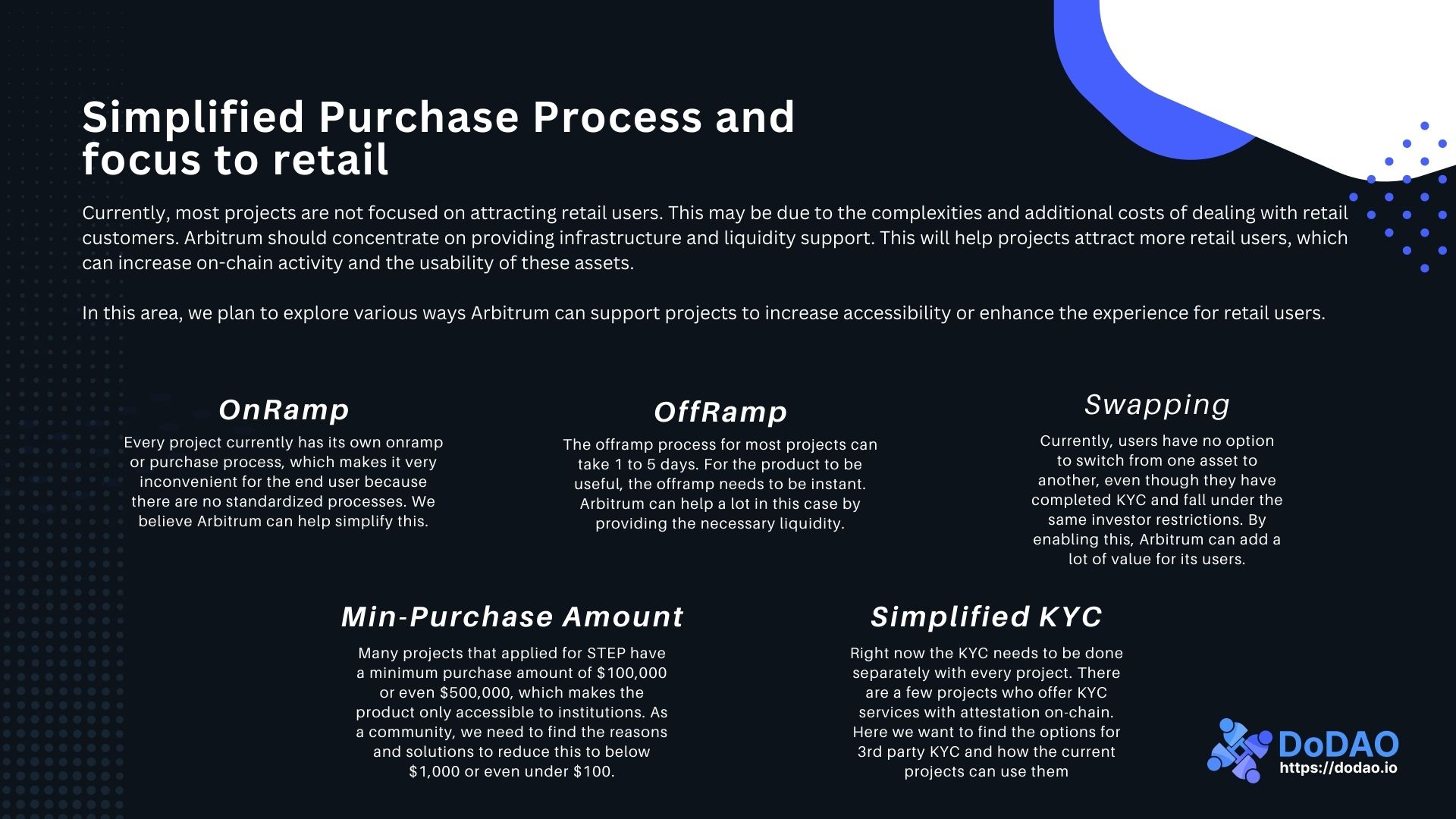

Simplified Purchase Process & Focus to Retail

Currently, most projects are not focused on attracting retail users. This may be due to the complexities and additional costs of dealing with retail customers. Arbitrum should concentrate on providing infrastructure and liquidity support. This will help projects attract more retail users, which can increase on-chain activity and the usability of these assets.

In this area, we plan to explore various ways Arbitrum can support projects to increase accessibility or enhance the experience for retail users.

- OnRamp: Every project currently has its own onramp or purchase process, which makes it very inconvenient for the end user because there are no standardized processes. We believe Arbitrum can help simplify this.

- OffRamp: The offramp process for most projects can take 1 to 5 days. For the product to be useful, the offramp needs to be instant. Arbitrum can help a lot in this case by providing the necessary liquidity.

- Swapping: Currently, users have no option to switch from one asset to another, even though they have completed KYC and fall under the same investor restrictions. By enabling this, Arbitrum can add a lot of value for its users.

- Min-Purchase Amount: Many projects that applied for STEP have a minimum purchase amount of $100,000 or even $500,000, which makes the product only accessible to institutions. As a community, we need to find the reasons and solutions to reduce this to below $1,000 or even under $100.

- Simplified KYC: Right now, the KYC needs to be done separately with every project. There are a few projects who offer KYC services with attestation on-chain. Here we want to find the options for 3rd party KYC and how the current projects can use them.

Benefits of Our Research

Here are some of the long term benefits of the research proposal outlined above:

-

Reduced Legal and Regulatory Costs for Builders: The research will provide builders with guidelines and best practices for navigating the complex legal landscape of tokenizing real-world assets. This could save them significant time and money, estimated at tens of thousands of dollars in legal fees and months of effort.

-

Enhanced Transparency and Standardization: By creating rubrics for evaluating real-world asset projects, the research aims to introduce standardized evaluation parameters. This will enhance transparency in the sector, helping users differentiate reputable projects from less reliable ones and making it easier for them to make informed decisions.

-

Increased Accessibility for Retail Users: The proposal seeks to simplify the process for retail users to engage with real-world assets. This includes streamlining the purchase process and standardizing KYC procedures, potentially leading to greater participation from a broader audience.

-

Foundation for Future Development: The detailed report and blueprints produced by the research will serve as a foundational resource for future developers and researchers interested in real-world asset tokenization. This could catalyze more innovation and development within the space.

-

Potential to Boost Economic Activity: By making real-world assets more accessible and understandable to retail users and reducing entry barriers for builders, the research could significantly boost economic activity on platforms like Arbitrum. This, in turn, may attract more users and investors to the ecosystem.

Effort and Cost Estimates

Team Effort: 2 Full-time Researchers for 7-8 weeks

Effort in Hours: 2 researchers * 40 hours/week * 8 weeks = 640 hours

Cost: $75/hour

Total Cost: 640 hours * $75/hour = $48,000

This will be the genuine cost of the research.

However, since we have already been working on some of these research topics and it aligns with our ongoing efforts and research, we plan to request a grant of 30,000 ARB or $25,000 for this project. We believe that this research will benefit the community and will help in establishing Arbitrum as a hub for RWAs.

RWA Research - Helping Builders and Users History

-

applied to the Arbitrum RWA Innovation Grant Program 8 months ago of which the application is still in a pending state