1. Proposal

1.1 Background

Over the past fifteen years, crypto and web3 have evolved from fringe experiments to global forces, reshaping finance and the digital world. Initially celebrated for enabling a decentralized revolution, blockchain now faces challenges like unsustainable economic models, fragile system designs, and increasingly sophisticated fraud schemes,etc. These challenges remind us that technological progress does not inherently lead to system resilience; it often accelerates hidden risks.The 2022 collapse of Terra/Luna, a $60 billion ecosystem, exposed vulnerabilities in decentralized design and highlighted the need for robust economic models.

In fact, as early as 2018, Token Engineering was proposed to infuse complex economic systems with scientific rigor and engineering discipline. However, despite growing recognition of its importance, its adoption has lagged behind demand, leading to a significant knowledge gap in the crypto space. The prevailing challenges in the crypto space stem not from a lack of technology, but from a profound knowledge gap. Current educational resources are often geared toward those with existing foundational knowledge, which can make it challenging for newcomers to fully grasp the complexity of protocol design.

To address it, our project aims to create an accessible, gamified course that introduces Token Engineering to the public, helping beginners understand its crucial role. In a complex world, understanding complexity itself is a form of power. Through this learning, only when the broader public grasps this complexity will Token Engineering become indispensable. This initiative will enhance public awareness and solidify Token Engineering as a core foundation of the crypto space.

1.2 Overview

In decentralized finance, where complexity often hides beneath simplicity, the intricacies of protocol design are the seeds of both success and failure. In a realm defined by innovation, the depth of understanding separates the builders from the bystanders. This project bridges that gap, helping the uninitiated grasp the profound challenges of token engineering.

Our objective is to demystify Token Engineering by creating a streamlined educational experience centered on foundational knowledge. True comprehension is not a matter of breadth, but of depth. We’ve distilled Token Engineering into its core components—simulation modeling, market behavior analysis, mechanism design, and environmental factors influencing system dynamics. By focusing on these pillars, learners can quickly grasp fundamental concepts without feeling overwhelmed.

We adopt a modular approach, breaking down complex systems into digestible units. Each module—whether on market dynamics, market makers, or arbitrage strategies—serves as a building block, allowing learners to piece together the larger puzzle of decentralized economics. Understanding arises not from absorbing the whole at once, but from mastering each part in turn. This structure simplifies learning and empowers learners to explore the interplay between components at their own pace.

To enhance engagement, we integrate gamified elements into the learning process. Through interactive simulations and hands-on experimentation, learners can manipulate parameters, observe outcomes, and refine their understanding of decentralized systems. Learning is not a passive act; it is an experience forged through trial, error, and discovery. This approach makes the complexities of Token Engineering both comprehensible and compelling.

Ultimately, this project is more than an educational course; it’s an invitation to delve into decentralized finance, confront its challenges, and gain a clearer vision of the forces shaping it. In a world where protocols dictate value, understanding their design is the first step towards mastery. Through this curated learning journey, we equip learners with the knowledge and tools to navigate and contribute to the evolving web3 landscape.

1.3 Details

Part1:Embarking on the DeFi Journey: A Foundational Introduction to Simulation

At this stage, our goal is to introduce learners to the basics of decentralized finance (DeFi) and the value of simulation. Learners will gain a fundamental understanding of DeFi protocol structures and learn how simulation tools can uncover deeper complexities within these designs.

In complex systems, crucial details often lie beneath the surface; understanding these details is the first step towards mastering the whole. Firstly, learners will explore the Terra model, gaining a high-level view of its architecture and core components, and understanding the essential roles these components play within the protocol.

Next, learners will use simulation tools to observe how adjusting parameters, like the initial supply of LUNA and UST, affects system behavior and market prices. This exercise highlights the value of simulation in revealing system dynamics and patterns.

Simulation is not just a tool for observing market changes; it’s a window into understanding protocol design and evaluating system robustness. Learners will see how simulation tests hypotheses and validates designs without the risks of real-world experimentation, allowing for a deeper exploration of underlying system logic.

The focus of this module is to provide a foundational understanding of DeFi complexities and the critical role of simulation in studying these complexities. In the world of simulation, we don’t just observe phenomena; we uncover causes. This understanding will prepare learners for deeper exploration in subsequent modules.

Part2:Mastering the Market Dance: A Token Engineering Perspective on Trading Behavior and Economic Resilience

In decentralized finance, trading behavior is like a delicate dance, where each step shapes the system's resilience. Within Token Engineering, analyzing these behaviors reveals market dynamics and provides crucial insights for designing and optimizing economic models. In complex economic systems, every trading action is like a stone cast into a lake; its impact extends far beyond the initial ripple. This module guides learners through the analysis of different market participants—traders, arbitrageurs, and market makers—and explores how these behaviors influence system resilience under various market conditions.

Learners will start by analyzing traders' behavior. As primary market participants, their actions offer insights into market sentiment and reactions. By studying their responses to different scenarios, learners will identify key factors that influence their decisions.

Next, the focus shifts to arbitrageurs and market makers. These actors play a critical role in market liquidity and system resilience. Learners will simulate how adjustments in market parameters affect their behavior, influencing market balance and stability. Every arbitrage action subtly reshapes the equilibrium of the economic system, posing new challenges for Token Engineering design optimization.

The key to optimizing protocol design lies in deeply understanding the motives and patterns behind behavior—this is central to the mission of Token Engineering. Throughout this process, learners will gradually recognize the close relationship between trading behavior and economic mechanisms, and how these behavior patterns can be leveraged in Token Engineering practice to optimize protocol design. By analyzing these behaviors, learners will understand how to enhance system resilience and mitigate risks.

The core of this module is to help learners establish a systematic analytical framework based on identifying trading behavior patterns, enabling them to understand and evaluate system resilience from multiple perspectives within the context of Token Engineering. This in-depth analysis will prepare learners to tackle more complex challenges in future modules.

Part3: Stability Through Precision: Unveiling the Core of Algorithmic Stablecoins

In the dynamic world of decentralized finance, algorithmic stablecoins represent a cutting-edge innovation, crucial for maintaining price stability. "In volatile markets, the stability of an algorithmic stablecoin is about more than just price; it’s about preserving the trust and resilience of the entire ecosystem." This module will immerse learners in the sophisticated mechanisms behind algorithmic stablecoins, focusing on how they achieve price pegs through careful design and dynamic adjustments.

Learners will begin by exploring the dual-token system of $UST and $LUNA, examining how these stablecoins maintain price stability through automated supply regulation. Stability in token engineering is attained by precisely balancing supply and demand through advanced mechanism design. The module emphasizes understanding the core logic behind these mechanisms, highlighting that price stability fundamentally depends on maintaining a continuous equilibrium between supply and demand.

Through simulation exercises, learners will analyze token minting and burning processes, observing their direct impact on price pegs. In decentralized finance, price stability is engineered, not incidental. These experiments will illustrate the critical relationship between token supply changes and market responses, showcasing the importance of precise operations within the stablecoin framework.

Moreover, learners will investigate how various design parameters influence the price peg, learning to fine-tune these parameters to optimize stablecoin performance. The success of an algorithmic stablecoin hinges on mastering design parameters and exercising precise control. This exploration will help learners progressively develop the skills needed to enhance stablecoin resilience under diverse market conditions.

The module's essence extends beyond algorithmic understanding, urging learners to recognize the real-world challenges these mechanisms face. Building a successful algorithmic stablecoin requires more than just theoretical insight; it demands ongoing adjustment and practical optimization. By the end of this module, learners will be well-prepared to tackle more complex market mechanisms and stablecoin designs as they continue their journey.

Part4: Decoding Market Dynamics: A Deep Dive into Volatility and Risk Management

In the decentralized finance landscape, market volatility is a constant force influencing ecosystem health and stability. "In a world of uncertainty, volatility reveals market behavior, while risk management is the cornerstone of system stability." This module explores the Terra/Luna/UST collapse, highlighting how market volatility can expose vulnerabilities in algorithmic stablecoins under extreme conditions.

Learners will start by analyzing the Terra/Luna collapse, understanding how different volatility models, such as Brownian motion and GARCH. Major market swings can unearth hidden flaws in system design, and Terra's downfall serves as a stark reminder.

Next, learners will design and test risk management strategies through simulation, recreating key scenarios from the Terra/Luna event. They will explore how precise control and optimization of parameters can help maintain system resilience in unpredictable markets. In Token Engineering, risk management is not just reactive but anticipates and mitigates future risks.

Finally, this module goes beyond theory, urging learners to develop a holistic perspective in Token Engineering. True resilience comes from mastering market dynamics and risk control, with Token Engineering offering the scientific tools to achieve this. This learning stage equips learners to tackle more complex market challenges in decentralized finance.

1.4 Potential innovation

In developing this Token Engineering course, we’ve introduced key innovations that stand out both technologically and educationally. The true value of innovation lies not just in novelty, but in its ability to transform how we learn, making complex knowledge more accessible and understandable.

First, we created a 'gamified learning pathway', embedding core Token Engineering concepts into interactive games. This approach allows learners to naturally grasp complex theories through real-world problem-solving. Gamification isn’t just about fun; it’s about simulating challenges that help learners internalize knowledge through practice. We carefully balanced gamification with educational depth to ensure each interaction aligns with learning goals.

Secondly, we implemented a layered and modular learning approach. Layered learning helps learners not just accumulate facts but develop the ability to integrate them into a comprehensive whole.The purpose of modularization is to facilitate the breakdown of complex systems for easier understanding, thereby lowering the barrier to comprehension.

Additionally, our course features "high-fidelity simulation experiments", offering a virtual environment where learners can experiment, make mistakes, and learn from them. Simulation allows for freedom and iterative feedback.

Beyond technology and methodology, these innovations aim to address the real-world challenges in Token Engineering education. Through these advancements, we strive to equip learners with essential knowledge and inspire them to contribute meaningfully to the decentralized future.

1.5 Project goals

Short-Term Goals

- Enhance the Existing Terra Model: Enrich the Terra ecosystem model by incorporating key components such as LUNA staking incentives and the Anchor protocol. This will provide a more comprehensive representation of the Terra protocol, laying a solid foundation for learners to delve deeper into the subject.

- Complete Gamified Course Design: Based on the expanded model content, introduce new parameter controllers and build new gamified learning pathways. These additions will help learners master advanced topics in Token Engineering, such as optimizing incentive mechanisms and mitigating market risks.

Long-Term Goals

- Promote the Adoption of Token Engineering: Through the development of gamified learning courses, we aim to explore further possibilities in Token Engineering education. Our goal is to facilitate the broader adoption of Token Engineering within a wider community by leveraging this innovative educational approach.

2. Team

- Cassinia: Researcher with ABM modeling skills and Web3 expertise, currently specializing in token engineering and protocol modeling.

- Jereyme: Token engineer with five TEA NFTs, specializing in crypto protocol design and optimization. Since 2022, she has been engaged in Token Engineering, fostering education and collaboration in the field.

- Aadith: 3+ years of experience in Web3 & Defi , interoperability and other themes as BD and growth. He also has good knowledge of Token Engineering and holds 3 TEA NFT badges and cadCad edu certificates.

Achievements

- Modellab team has achieved the two milestones of the TEC GG20 Grant using HoloBit: developing the PAMM Bonding Curve model and the integrated PAMM&SAMM model.

- AAVE&GHO Grant: https://checker.gitcoin.co/public/project/show/community-friendly-gho-simulation-model

- TEC Grant: https://checker.gitcoin.co/public/project/show/protocolguardai-driven-exploring-potential-malicious-strategies-in-pamms-samms

3. Current State

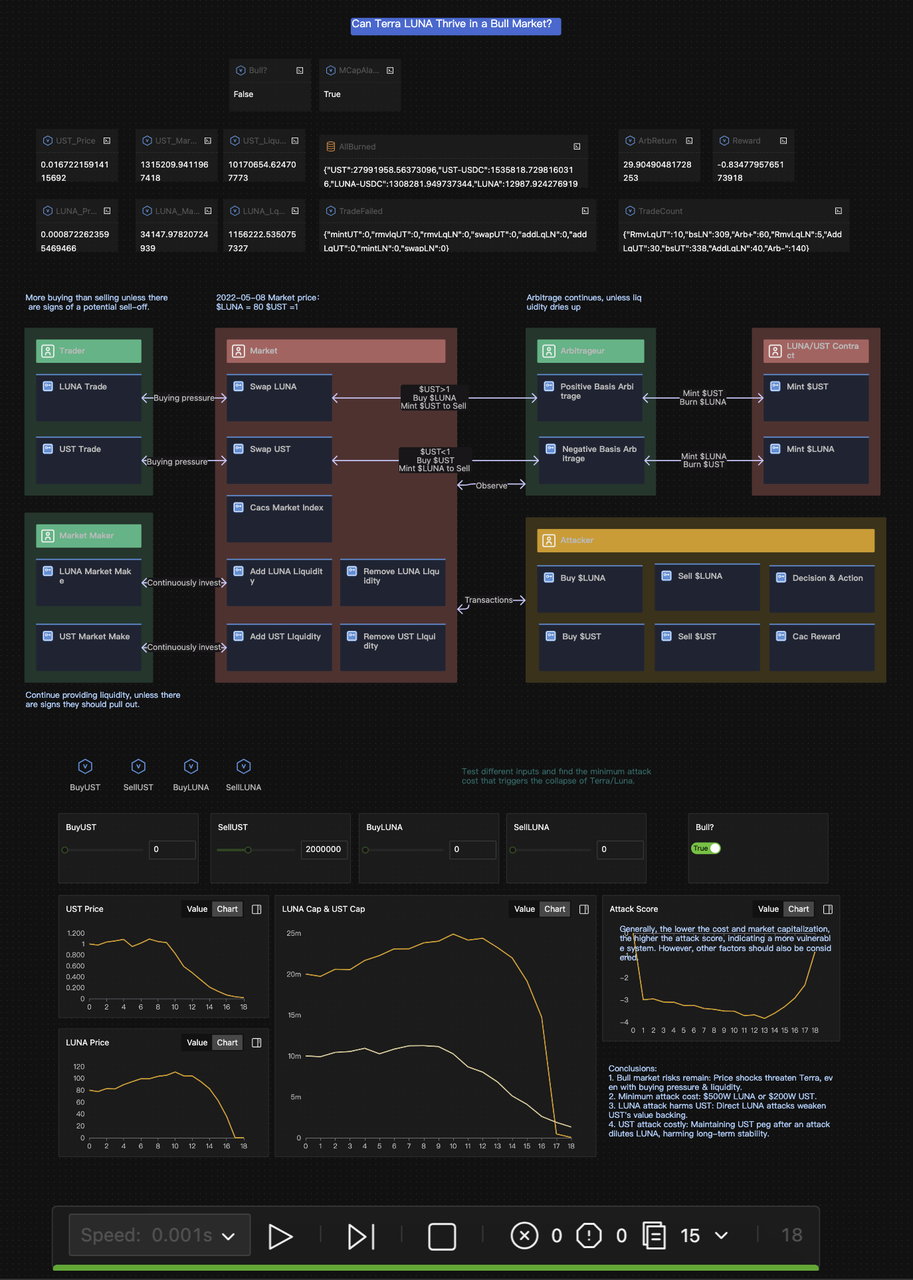

We have built the initial Terra/Luna off-chain model as follows:

https://app.holobit.world/embed/fcabebbb31d17fe47cd6148107fe974eabf20f28fcefb226561928eb3dff39e6

Regarding course design, we have completed the construction of the basic framework. For more details, please refer to 'Proposal details'.

4. Expected Deliverables

Terra/Luna Protocol OffChain Model, including:

- Core Modules: Trader, Market Maker, Arbitrageur, Market,LUNA/UST Contract, Attacker.

- Scenarios: Base Trade | Protocol Peg | Liquidity | Bearish Risk | Bullish Risk |Attack Cost

- Adjustable Parameters: Each scenario includes adjustable parameters tailored to course learning needs.

- Market Volatility Simulation: The model incorporates processes to simulate various market volatility scenarios.

Learning Courses: A comprehensive set of course modules will be on Notion, including:

- Embark on the DeFi Journey: A foundational introduction to simulation.

- Mastering the Market Dance: Trading behaviors and economic stability.

- Stability through Algorithms: Exploring the core mechanisms of algorithmic stablecoins.

- Decoding Market Dynamics: A comprehensive analysis of volatility and risk management.

Each module includes detailed objectives, specific actions, and challenges to be tackled.

5. Mission and Value Alignment

Accessibility: Education shouldn’t be an unreachable ivory tower; it should be a bridge. Our primary mission is to make Token Engineering education widely accessible, lowering the barriers to entry. We aim to transform Token Engineering education into a bridge that connects more people to the decentralized future.

Education: We are committed to enhancing learners' practical skills through innovative educational methods. Our courses combine classic protocol simulations with interactive learning, ensuring that learners not only grasp the theory but also apply this knowledge effectively in real-world scenarios.

Transparency: Transparency is a fundamental principle in every aspect of our project. All models and course content are presented openly for scrutiny and improvement by learners and the community. This transparency ensures that every step can be examined, understood, and validated by the community.

Community-Driven: Community involvement is key to our project’s success. We will actively seek support from the TEC and Optimism communities & superchain eco, encouraging learners to participate in course development and refinement. By broadening community engagement, we aim to make the course a collaborative effort shaped not only by us but by the community as well.

Alignment with Token Engineering Principles: Our project strictly adheres to the core principles of Token Engineering, aligning course content and methods with industry standards. “These principles are the foundation and compass of our educational mission.” By integrating real-world case studies and simulations, we aim to help learners understand and apply these principles, broadening the reach of Token Engineering knowledge.

In understanding the true nature of token engineering, we move from fear of the unknown to a clear and optimistic vision for the future.

Token Engineering for Everyone: An Interactive and Enjoyable Learning Path History

-

applied to the Token Engineering the Superchain 7 months ago which was rejected